Labour’s scary Autumn Budget for wine

Posted by Gavin Quinney on 31st Oct 2024

Ah, the Autumn Budget, and a new dawn? A 1p reduction in the duty on a pint of draught beer? Hooray! No doubt the pubs are getting the Bonfire Night bunting out.

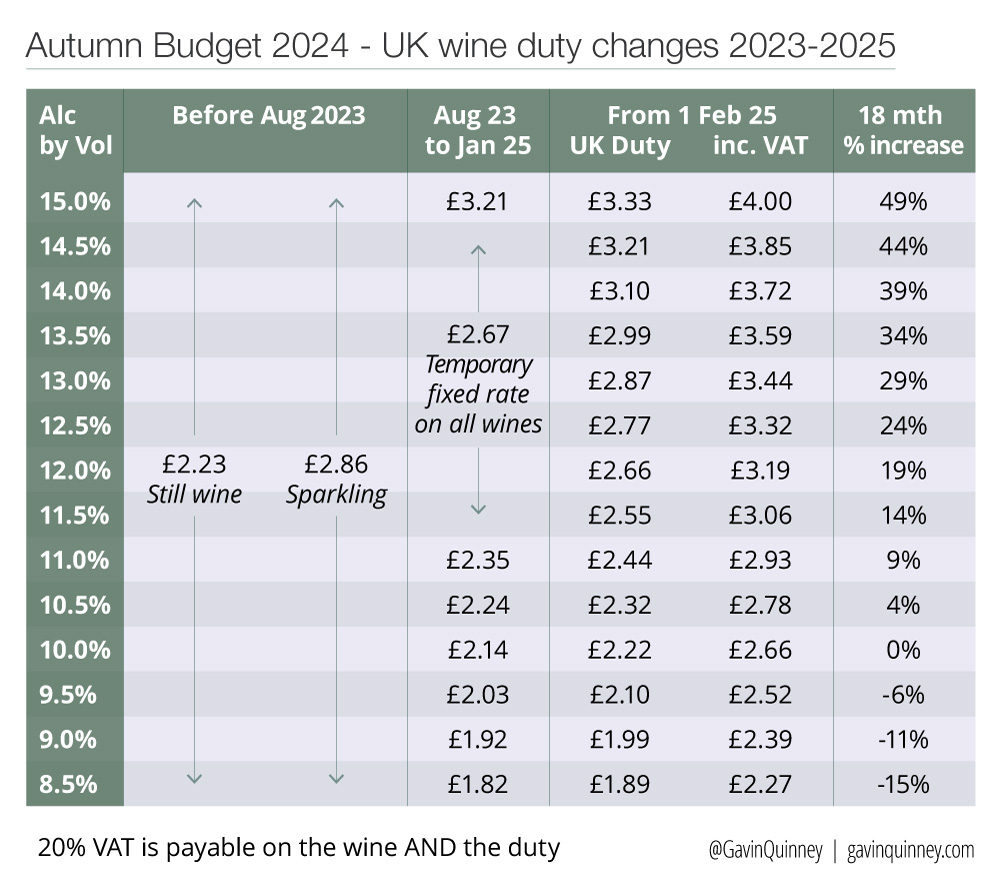

A horror show fit for Halloween, more like, for the UK wine trade and their customers. You’d never grasp that from the analysis of the Budget in today’s papers, however. Below is my table of where we were last year with UK duty on wine, where we are now with the so-called ‘easement’ for most wines today, and where we’re headed. The future for many is not looking too bright.

Meanwhile, the last of this year’s guests in our farmhouse leave tomorrow, as we close the house up for its annual, winter rest – much like the vines. The price and availability page for April to October 2025 is now live on our website. Apologies in advance that most of the weeks next summer have been snapped up but there are lots of slots still free in the spring and the autumn.

If you have any questions, suggestions or would like to get in touch, please email us both by clicking this link.

All the best

Gavin & Angela Quinney

Labour’s scary Budget for wine lovers

As many readers will know, we have a bit of a thing about UK duty. That’s not just because we pay an awful lot of it as our wine travels through our UK bonded warehouse on its merry way to private and trade customers, but also because we can see the increasing damage it’s doing to the quality, choice and price of wine on offer in the UK. We also see at close hand just how duty compares to what consumers have to pay in Europe.

The so-called ‘easement’ to end

We last wrote about this subject at the end of June in the newsletter entitled ‘Sunak’s wine legacy’. Labour have regrettably now followed his lead, and even upped it.

- ‘Alcohol duty rates on non-draught alcoholic products will increase in line with RPI inflation. These measures will take effect from 1 February 2025. The current temporary wine easement will also end as planned on 1 February 2025.’

‘Alcohol Duty uprating’ – more utter hogwash on Gov.uk post Budget.

The bad news for the UK wine trade and for a great many wine lovers is the end of the temporary fixed rate on wine, as well as another increase. One rate of duty for wines today between 11.5% and 14.5% abv will be replaced by 30. We’re still trying to figure out why anyone would think this is a good idea, except the anti-alcohol lobby of course.

Duty up again

There’s another increase, with a rise of 3.65% RPI on 1 Feb, reflected in my table above.

£3 duty on a bottle of wine at 13.5%? Crikey. That means that in a £9 bottle at 13.5% abv from 1 Feb, the UK tax will be 50% (£3 duty and £1.50 VAT). On a £7 bottle at 13.5%, 60% will be UK tax. More on this below, as well as what to expect in the next few months: offloading, in a word.

This is the response to the Budget from our friend Miles Beale, the Chief Executive of the Wine and Spirit Trade Association – as he said privately, ‘in full frothing mode’:

“The Chancellor’s decision to increase alcohol duty by RPI is a real kick in the teeth for both businesses and consumers. We simply cannot understand why Government has said they are trying to protect income and in the next breath raising alcohol duty in a move that is totally counterproductive. Recent history has shown us that duty increases lead to price rises for consumers, a dip in sales and, as a result, fewer receipts for the Treasury. The near £500 million loss in alcohol duty receipts, in the last six months, couldn’t make that clearer.

We are bitterly disappointed that Labour, despite their manifesto pledge to prioritise growth, has chosen not to listen to business – especially SMEs, which will be hit hardest of all. Instead of reversing the last Government’s damaging plans to bring in unnecessary, complex and costly changes to the way wine is taxed, Labour wants to plough ahead. And for what?

Raising alcohol duty and ending the wine easement will not bring in more revenue for the Chancellor, but it will mean businesses will now be obliged to tussle with more costly and complicated red tape. This will increase costs and push up prices for consumers and make economic growth unlikely or unachievable.

It’s bewildering that Labour has chosen to support a Rishi Sunak-inspired tax complication when a long, desperate queue of wine retailers and businesses have beaten a path to the new Government’s door to explain why abolishing the easement adds pointless cost and complexity and undermines economic growth. The decisions made at this Budget are a bitter blow for all, they will stifle the growth of British business and add another nail in the coffin for hospitality and result in less choice and price rises for consumers.”

It may be too late but write to your MP?

I am reliably informed that a number of important people in all this are not quite clear about what all this means. If by reading this you feel inspired to email your MP with a download of the table above, or whatever, you’ll find the register of MPs here.

Having said that, it’s almost two years since we asked customers to write to their MPs when this daft process first began. And here we still are.

A few facts about the duty changes

Prior to 1 August 2023, UK duty on wine between 8.5% and 15% was £2.23 for still wine and £2.86 for sparkling wine, plus VAT. Rishi Sunak, as Chancellor and then Prime Minister, brought in the new method of taxing wine based on the percentage of alcohol.

The Conservative Government saw this as a (somewhat weird) benefit of Brexit, because in the EU wine is treated as an agricultural product, unlike beer and spirits which are made to a recipe and to pre-defined alcohol levels.

Taxing on the level of alcohol sounds simple enough but the two previous bands of duty between 8.5% and 15% (still and sparkling) would be replaced by 64 levels – one for every decimal place potentially, eg 11.3%, 11.4% and so on. If you include all ‘wine’ from 1.3% to 22%, including low alcohol versions of ‘wine’ and fortified wines like sherry, there are over 200 bands of duty on wine from 1 Feb 2025. Sheer lunacy.

Sunak’s government belatedly conceded, after the widespread opposition since 2021, that the administrative burden on the wine trade was huge as there are tens of thousands of different wines and the alcohol level can change with every vintage.

So when the new system was brought in on 1 August 2023 there was a temporary stay of execution on wines between 11.5% and 14.5% (85% of all wine sold in the UK, according to the Wine and Spirit Trade Association). A fixed rate of £2.67 on wines in this bracket was to run from 1/8/23 to 1/2/25. This was called ‘the easement’ and therefore a new Government was going to be lumped with rolling it out.

Nonetheless, the 20% increase on still wines from £2.23 to £2.67 plus VAT in August 2023 (54p a bottle) was the biggest in 50 years.

But worse is to follow with this enormous pile of red tape for wine merchants, importers, agents, bonded warehouses, HMRC, customs agents (which we’ve only needed since Brexit), plus higher duty rates for all wines over 12% abv. This assumes, by the way, that the alcohol level on the label – from which the duty is determined – is accurate (!).

Labour haven’t listened

A few wine merchants have been emailing their customers in recent weeks, asking them to write to their MPs. They include John Colley, the CEO of Majestic, and Steve Finlan, the CEO of The Wine Society.

Even we were asked to say a few words on BBC Radio 4’s PM (hardly ideal timing when you’ve got a coldy, gravelly voice) on 21 October.

The relatively light hearted but serious report lasting 6 minutes starts around 31 minutes 25 seconds in – move the start point to there:

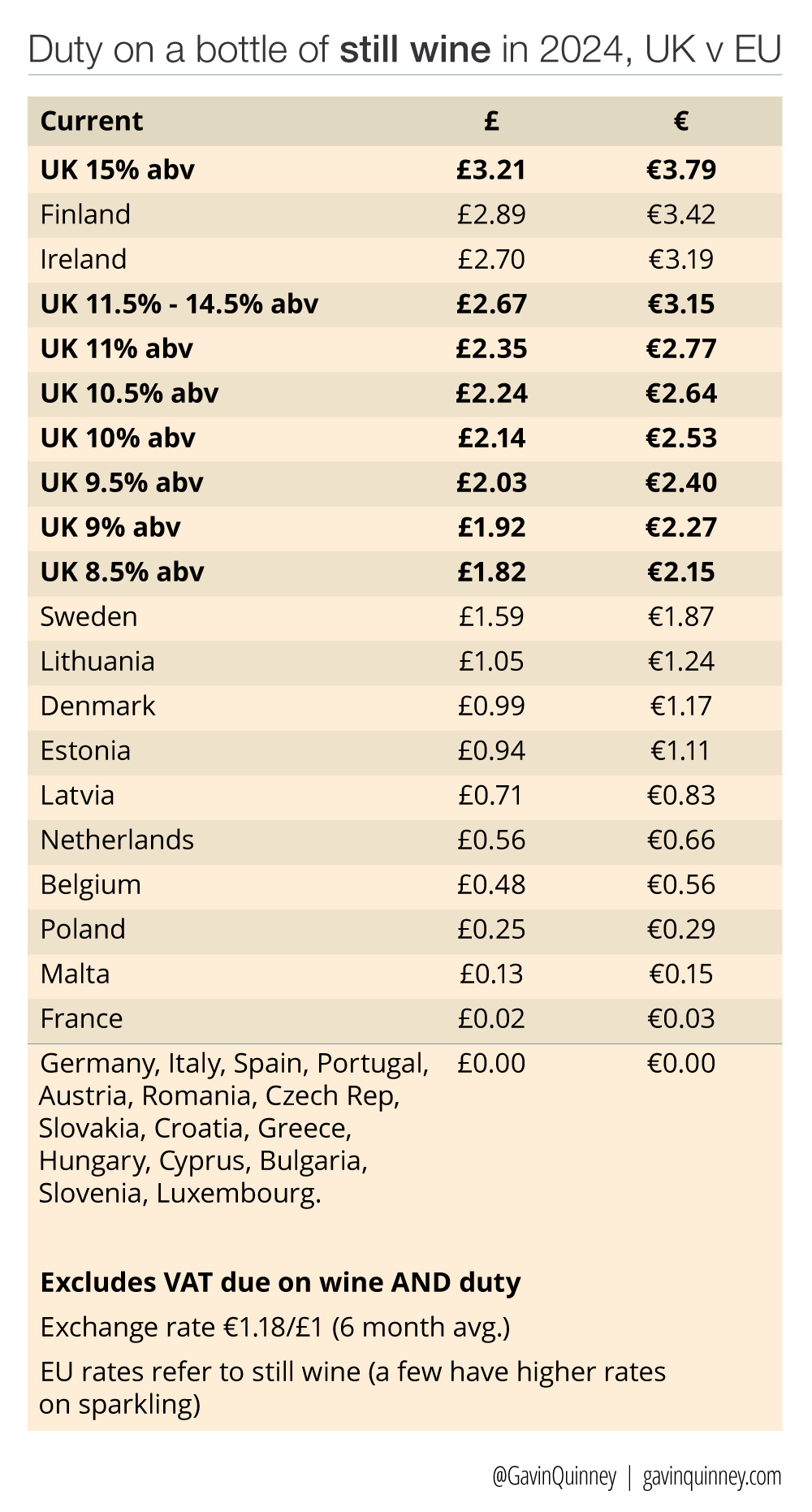

How UK duty compares to the EU

From 1 February 2025, the UK duty on a bottle of wine at 13% abv (£2.87 plus VAT) will be double that of the total duty charged on a bottle in no less than 20 EU states combined (€1.69 plus VAT), including the Netherlands, Belgium and Poland. In France, it’s 3p. A Brexit benefit? Seriously?

This is the current ranking:

From 1 February 2025 the UK knocks the others out of the park.

The wines most affected from 1 February 2025

Well, obviously wines like Château Lafite or Château Figeac aren’t impacted. This was the harvest there earlier this month.

But red Bordeaux at the cheaper end will be. This below was a mixed case of six different red wines I bought from The Wine Society. The wines cost about £8 each, with 50% of that being UK tax today. All bar one were perfectly drinkable and enjoyable, in my humble opinion.

For the wine at 13% abv, the duty will go up 20p a bottle plus VAT. For those ‘riper’ wines at 14% and 14.5% the duty will go up by 43p and 54p plus VAT respectively. I reckon that the duty increase alone in February wouldn’t be a million miles away from the purchase price of the liquid itself (probably by a middleman) before the wines were collected in bulk from around the region to be bottled at a facility just up the road from us. The least attractive wine, incidentally, was actually the one with the lowest alcohol.

A swathe of supermarket reds

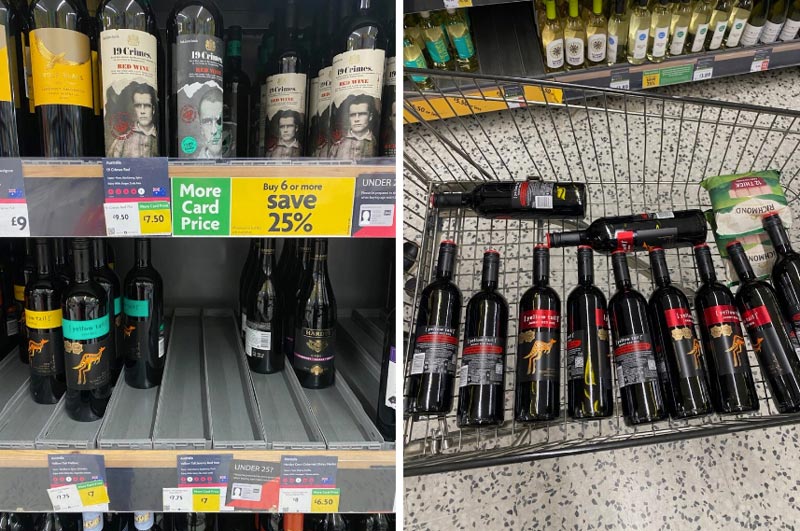

While I was in Worcestershire visiting my mother this month I also had a quick look in the wine aisles in both Waitrose and Morrisons.

All these 14% – 14.%% reds, from France, Italy and Australia, will see increases in duty of 43p or 54p plus VAT from 1 February.

Fair play to the couple who cleared the shelf of their favourite Yellow Tail at a card rate of £7 less 25% for 6 or more bottles. “It’s very drinkable” they said when I asked them if I could take a pic of their trolley. That’s £3.55 UK tax out of the £5.25 a bottle they paid. I think we’ll be seeing a bit more of that in the months to come.

UK duty up to SEVEN times the cost of the liquid itself?

With such high duty (£2.67 plus VAT for 11.5% to 14.5% abv currently) how can the bottles be on offer at just 2 for £11 or 25% off and the like?

Most of the wines on the shelves are from big brands or are ‘own label’. They’re often made from bulk wines and blended to suit.

‘World trade of bulk wine represents roughly one-third of total wine trade by volume but only 6.6% by value, given its low average price of €0.73/l at the end of 2023.’ Meiningher’s International, the wine and drinks industry journal, 22 October 2024.

So the average price of 0.73/l is 0.55/75cl for bulk wine, or 46p at €1.18/£1. For a third of the total trade by volume.

That’s a global average but let’s take Australia specifically as it has the largest share of the ‘off-trade’ such as supermarkets with 23% market share, ahead of Italian wine with 13% share, France with 11% and Chile with 10%. That’s according to Circana in the 12 months to the end of September 2024, as quoted by the Export Report by Wine Australia, 18/10/24.

The UK is Australia’s largest export market by volume with 222 million litres shipped in the 12 months to the end of September 2024. The USA is next with 113 million litres. (China is their biggest market by value.) 200 million litres or 90% of the wine to the UK was shipped in bulk (unpackaged) in huge containers and is bottled or packaged in the UK, which makes sense for all sorts of reasons. The average export value of those 200 million litres was 1.21 AUD per litre, or 61p/litre today. That’s just 46p for 75cl, before packaging.

So from 1 February 2025 we’re going to see UK duty on a 14.5% wine from Australia go up by 54p plus VAT, having already gone up by 44p plus VAT last August. The duty will be £3.21 plus VAT on a wine where the liquid itself has a value, on average, of 46p. That will be SEVEN times the cost of the liquid itself.

I just find that statistic mind blowing. The Australians must surely be livid.

The biggest worry

When duty went up by over 50p a bottle last August, the fallout from the slow but inevitable price increases on the shelves was that customers switched to cheaper brands at the price point they could afford or were prepared to pay. We know of one good supermarket brand that lost 20% market share in the UK when their ‘offer’ price went from £6.99 to £7.49 due to the duty hike. So customers either stopped buying or more than likely they switched to other lower priced brands.

It truly will be a spiral to the bottom.

I predict a riot

No, nothing untoward from well mannered merchants or lovers of punchy chardonnay or Châteauneuf-du-Pape. More a surge of sales of higher alcohol wines before Christmas – and well beyond into the first quarter next year – until stocks are cleared.

Like the increased passenger duty for Rishi flying in a private jet: brace, brace.

Onwards and upwards.