Sunak’s wine legacy

Posted by Gavin Quinney on 29th Jun 2024

“So today, we are taking advantage of leaving the EU to announce the most radical simplification of alcohol duties for over 140 years.” Rishi Sunak’s Budget speech as Chancellor, October 2021.

Well, judging by his duty bands for 1 February 2025, that’s far from a ‘simplification’ and most wine drinkers in the UK wouldn’t say it’s ‘taking advantage of leaving the EU’.

Our newsletter at the end of June last year was ‘A guide to UK duty hikes on wine’ and below is an update. A 53p increase in duty per bottle for most wine (44p plus VAT) to £2.67 plus VAT last August was bad enough, but there’s trouble ahead.

We are one of many signatories to a letter in The Independent today, Saturday, all being well. (Our UK company imports and delivers our wine.)

‘As a coalition of wine businesses from across the UK, we are publishing this letter to urge the next Government to commit to making the temporary easement for wine between 11.5-14.5% permanent ahead of its planned expiry on 1st February 2025.

‘It is vital that the incoming Government acknowledges that withdrawing the easement would create significant and unnecessary one-off and ongoing running costs, as well as imposing unmanageable operational complexity. Making the easement permanent would maintain one fixed duty payment for over 85% of wines across the UK market.‘

The rest of the letter is shown below.

Here at the ranch, meanwhile, we’ve had some much needed sunshine this week, not least in the vineyard which has gone a little crazy with some excited growth over the last few days. The new grapes are at the petit pois stage, which is pretty self explanatory.

All the best

Gavin & Angela Quinney

Sunak’s wine legacy – and what’s to be done

Before the Prime Minister disappears in a well-minted puff of smoke, it’s worth noting just how grim his legacy could be for wine in the UK.

Some of the points covered:

- The changes last August

- Alcohol levels on UK labels

- Red tape and higher duty from February 2025

- Make the temporary ‘easement’ permanent

- The highest duties in Europe on the cards

- The source of Sunak’s ‘Brexit benefit’

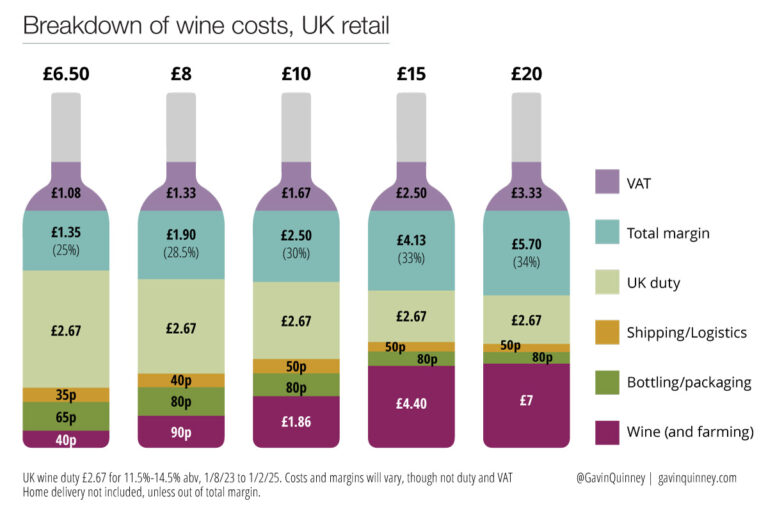

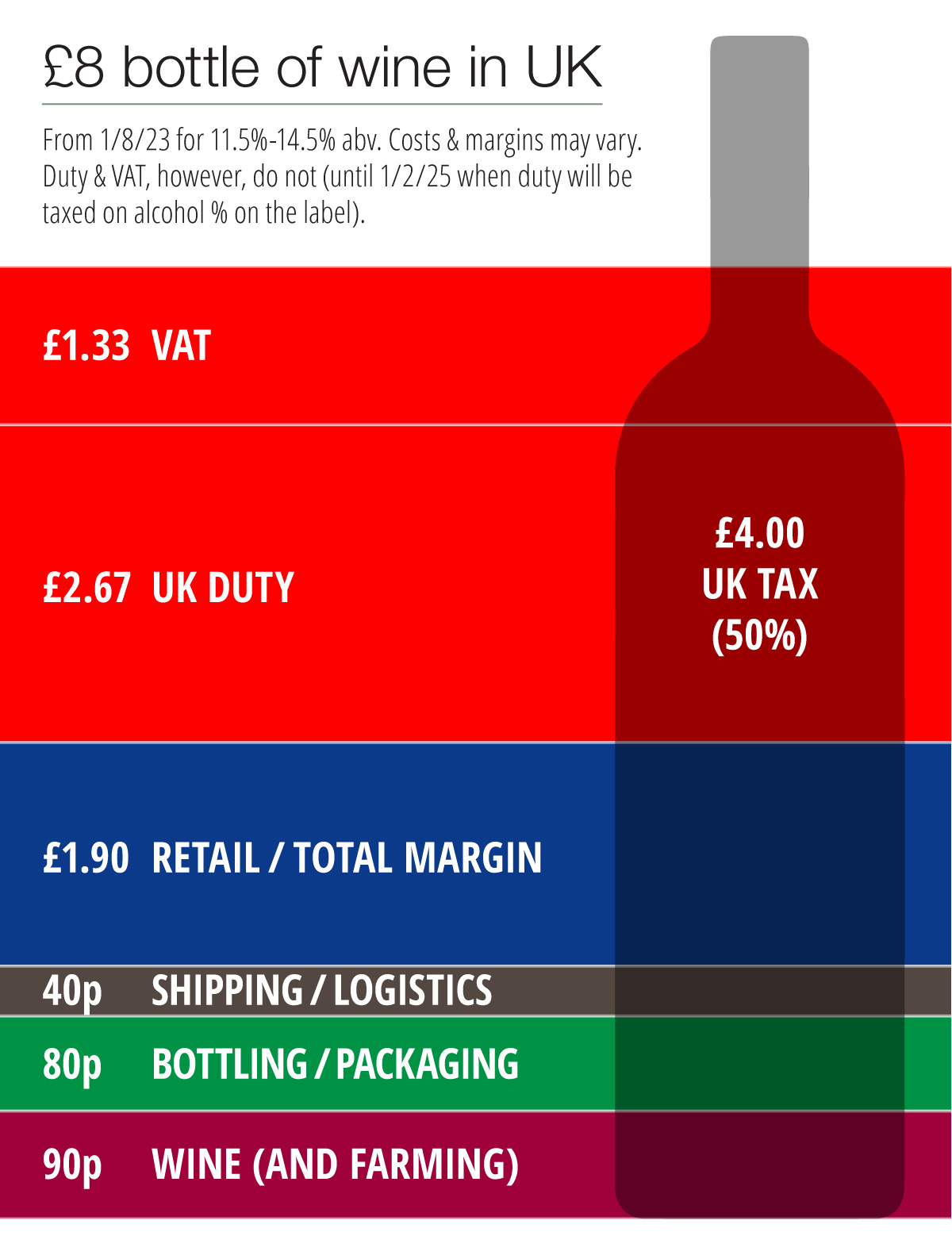

- 50% of an £8 bottle is UK tax today

- Wine in bulk is (mostly) cheap

The changes last August

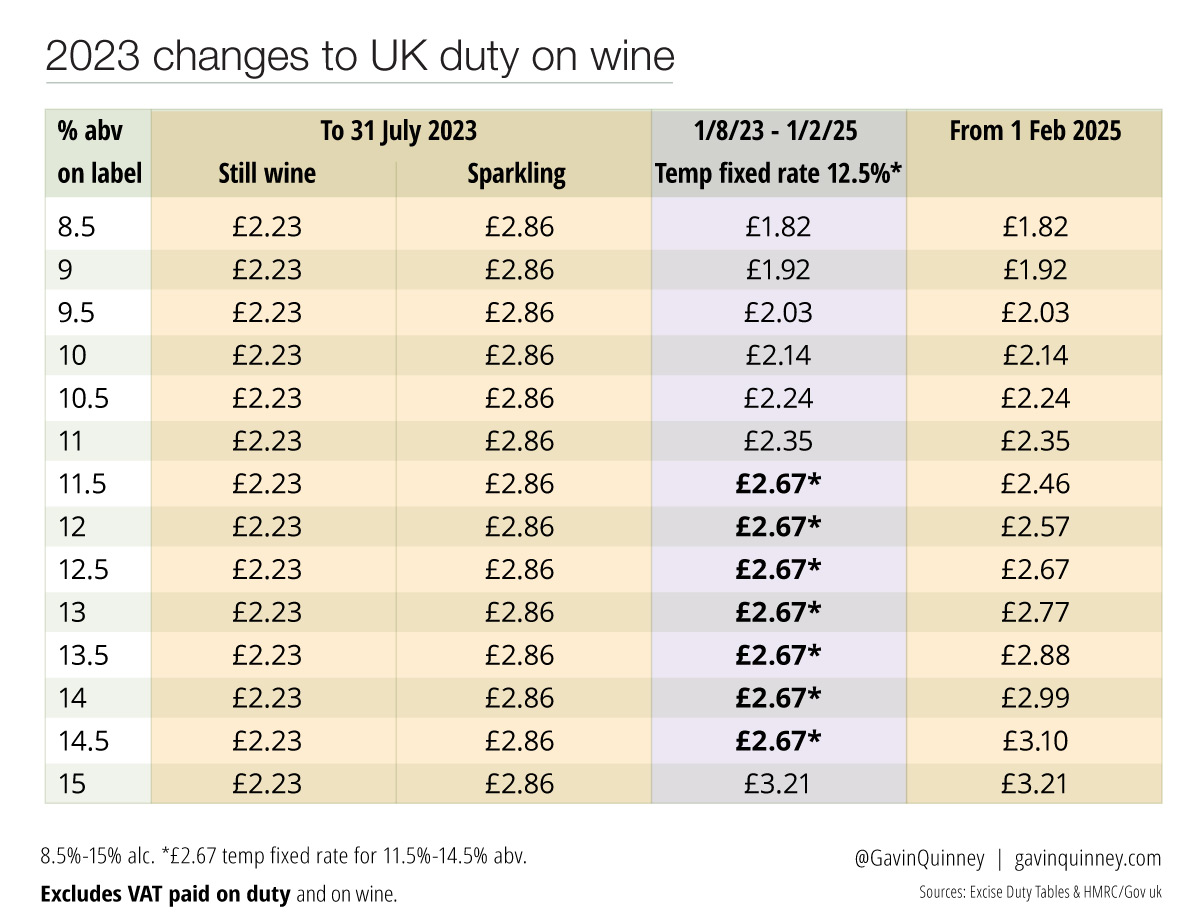

Prior to last August, UK duty on wine between 8.5% and 15% was £2.23 for still wine and £2.86 for sparkling wine, plus VAT. Sunak, as Chancellor, introduced the new method of taxing wine based on the percentage of alcohol (as some sort of Brexit benefit, but more on that shortly). The two previous bands of duty would be replaced by umpteen levels.

The government realised – after widespread opposition – that the administrative burden on the wine trade was so huge that when the new system was brought in last summer there was a temporary stay of execution on wines between 11.5% and 14.5% (85% of all wine according to the Wine and Spirit Trade Association, or WSTA). A fixed rate of £2.67 on wines in this bracket was to run from 1/8/23 to 1/2/25.

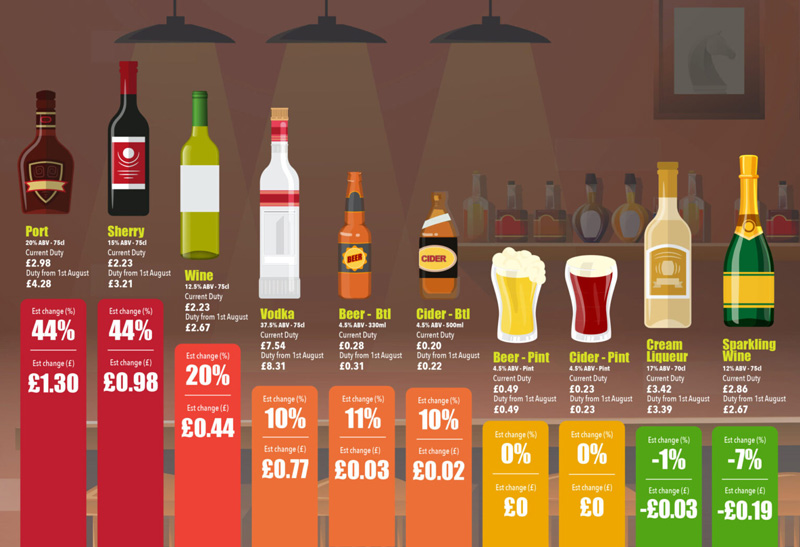

Here were the changes to alcohol duty across the board:

(Someone emailed me this graphic and I saved it but cannot recall who it was, so my apologies for not giving the appropriate credit.)

The 20% increase from £2.23 to £2.67 on still wine (1 in 8 bottles sold) was a tough one and the effects are certainly being felt today. It was the biggest rise in 50 years: on a £5 bottle of wine, £3.50 is UK tax. That’s 70% tax in duty and VAT on a bottle that not so long ago was the average price paid in a supermarket.

Duty on still or fortified wine that’s labelled at 15% alc by volume (abv) went up from £2.23 to £3.21 plus VAT. Port and sherry were horribly hit, with a port of 20% abv going up from £2.98 duty to £4.28 plus VAT.

(The WSTA reports, by the way, that increases to duty last August have already reduced year-on-year overall alcohol duty receipts for the Treasury by approximately £450 million between September 2023 and March 2024.)

Alcohol levels on UK labels

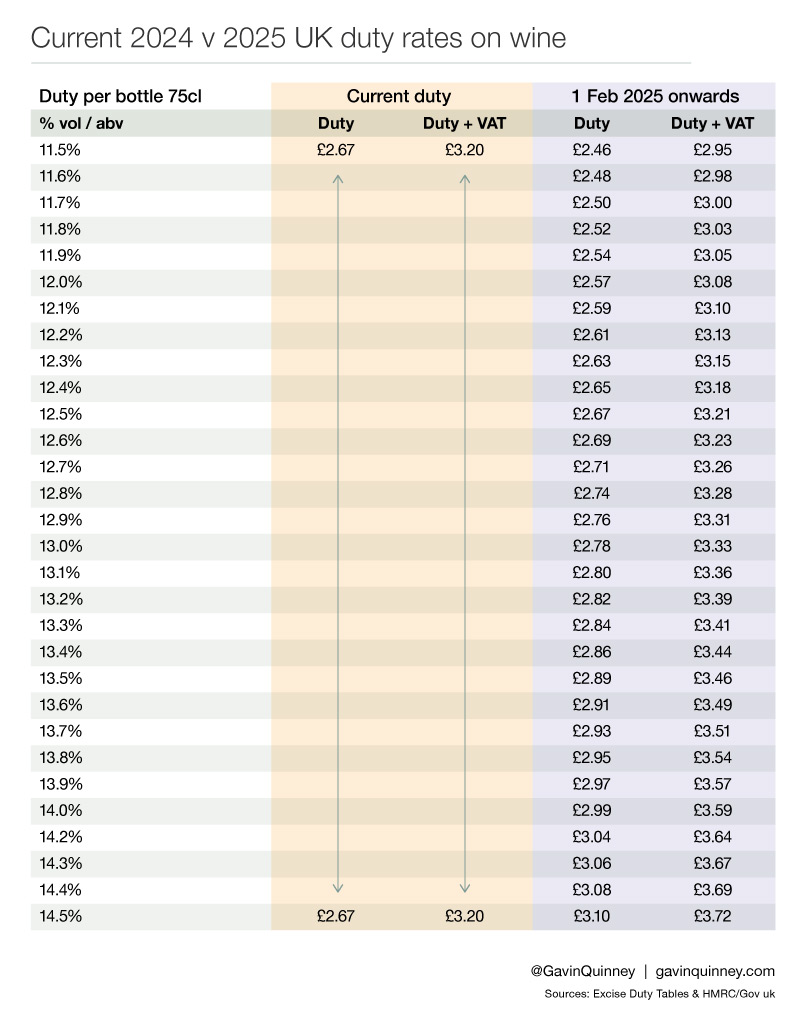

This falls into the ‘you can’t make this up‘ category. At the same time that the Treasury was introducing the new duty system, DEFRA also made use of their new ‘Brexit freedoms’ by moving away from EU regulations of having wine labelled in 0.5% abv increments (12%, 12.5%, 13% etc) to allowing alcohol by volume to be available at every decimal place for the UK market (12%, 12.1%, 12.2%…).

Suppliers are not obliged to put the alcohol level to the nearest decimal point, as the EU standard labelling is permitted (the UK government isn’t entirely stupid), but it is an option.

Red tape and higher duty from February 2025

So when the ‘temporary easement’ ends on 1 February, there’ll be 64 different duty bands on wines between 8.5% and 15% abv (replacing just two bands pre-1/8/23). Note that the alcohol level for all these wines might change with every vintage.

If you take all alcohol levels from low alcohol ‘wine’ at 1.3% abv through to fortified wine at 22%, there will be over 200 bands of UK duty.

Make the temporary ‘easement’ permanent

That’s it. That’s all a new government has to do. Stop the changes, and the further duty hikes on any wine of 13% or more, that are due to come in on 1 February 2025. Keep it simple for business and consumers – it’s hard enough as it is. (I should point out that it makes little difference to us personally either way as we have so few products, but the damage to the UK independent wine sector could be immense.)

We’re members, trading as Bauduc Limited, of the WSTA. They have produced a Briefing document on the ‘easement’ and why it needs to be made permanent – click here for the pdf.

Here’s the letter that we signed up to in the Independent today.

‘As a coalition of wine businesses from across the UK, we are publishing this letter to urge the next Government to commit to making the temporary easement for wine between 11.5-14.5% permanent ahead of its planned expiry on 1st February 2025.

em>‘It is vital that the incoming Government acknowledges that withdrawing the easement would create significant and unnecessary one-off and ongoing running costs, as well as imposing unmanageable operational complexity. Making the easement permanent would maintain one fixed duty payment for over 85% of wines across the UK market.‘

em>‘The UK wine and spirits industry generates over £70 billion in economic activity, and over 60% of the sector’s 413,000 FTE jobs are supported by the hospitality sector.

‘An incoming Government should recognise this economic contribution and commit to working towards a sustainable and proportionate regulatory regime that helps to protect an SME-rich industry in the UK, including over 1,000 independent wine merchants. Since last August, businesses have already had to adapt to the largest duty increases in almost 50 years: adding an average of 20% in duty on a bottle of wine and over 10% for spirits.

em>‘A new Government must act. Maintaining the easement would be a common-sense, business-friendly solution avoiding needless cost increases and unnecessary red tape.’

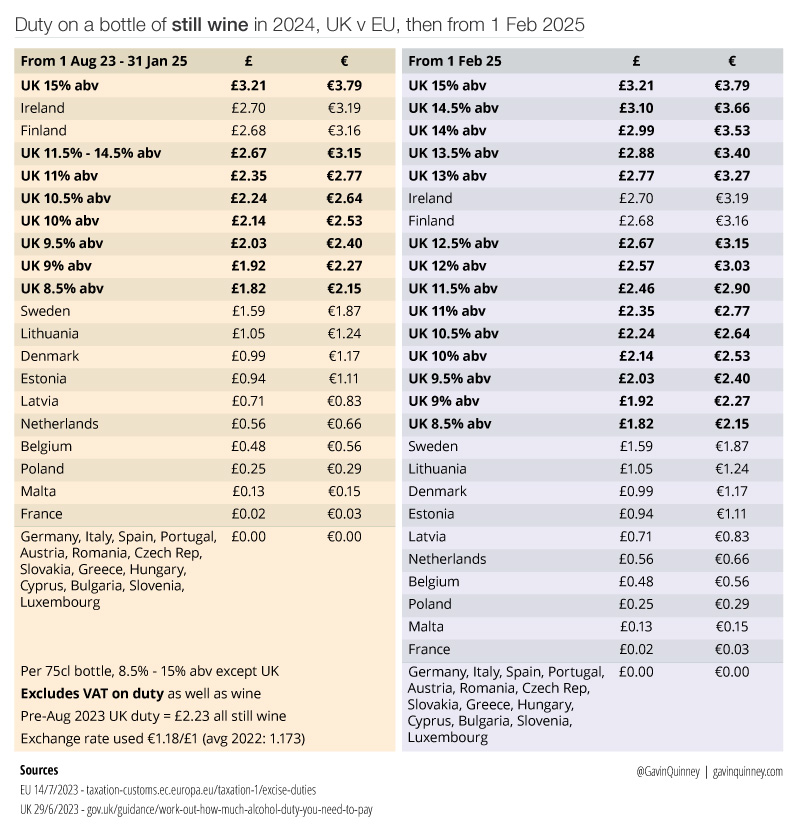

The highest duties in Europe on the cards

Even with the temporary easement for 11.5%-14.5%, the UK has one of the highest levels of duty in Europe. With the current plan to end the easement, the UK will have the highest duties in Europe for any wine of 13% or more – and certainly the most complicated duty system.

But we’re not all doomed just yet. The worst of Sunak’s plan can be avoided.

The source of Sunak’s ‘Brexit benefit’?

“What’s important now is that we deliver on the benefits of Brexit. And just to give you some examples of things I’ve been doing … we’re reforming the system of taxation for alcohol duties” boasted Sunak on 17 July 2022, in a debate on ITV with Liz Truss during the Tory leadership campaign (which he lost).

So why did Sunak go for taxing wine on the level of alcohol and the extra administrative burden?

Wine is defined in the EU legislation (Reg (EU) 1308/2013) as a “product obtained exclusively from the total or partial alcoholic fermentation of fresh grapes, whether or not crushed, or of grape must”.

The treatment of wine by the EU as a natural, agricultural product, as opposed to beer or spirits being made to a fixed recipe, is the issue here. Wine cannot be made to a pre-determined strength.

As a teetotaller and Brexiter, it seems highly likely that Sunak found a 2019 report by the Social Market Foundation called ‘Pour decisions: The case for reforming alcohol duty’ fitted his agenda rather well. (Boris Johnson became PM in 2019 and Sunak Chancellor in 2020.)

Skip through to page 68 and the ‘Conclusions’, among similar references from the Executive summary onwards:

“Brexit could open up opportunities for significant reform of the UK’s alcohol duty system, allowing the creation of a more rationalised and effective tax regime. This includes enabling on-trade and off-trade alcohol consumption to be taxed at different rates and allowing wine and cider to be taxed according to their alcohol content, rather than the volume of the final product as is the case at present. European directives mean that these reforms are not possible at the moment, and we urge policymakers looking for tax and regulatory reforms “unlocked” by Brexit to consider the case for rethinking alcohol duty.”

Hal Wilson, the owner of Cambridge Wine Merchants, points out in his fine article in The Buyer last month that ‘the report was funded by the Institute of Alcohol Studies which in turn is funded by the prohibitionist Temperance Alliance House Foundation (sharing trustees and receiving £603,000 in grants and rent).’

‘Is the unmanageable administrative burden placed on businesses by taxing all wine by alcohol level, on balance, more likely to be the intended consequence of the Alliance House Foundation rather than the unintended consequence of an incompetent government department? The more the Treasury doubles down the more I wonder.’

Today, 50% of an £8 bottle is UK tax

Where are we at today with wine? In my ‘guide to UK duty hikes on wine‘ last year, I suggested that, more than ever, ‘drink less but better’ might be the message with wine duty going up by 44p a bottle plus VAT.

Looking at some supermarket wine aisles in the Midlands last week, and tasting some of the bottles, ‘drink less but better’ would certainly be my view. Only, my word, it’s hard for a customer to know what’s what, price-wise. In general, the safest thing to assume is that any ‘offer’ price is the real price.

A key takeaway is that half of a bottle costing £8 is UK tax (£2.67 wine duty plus £1.33 VAT). If you can, trade up – though try not to be fooled by the pseudo, not-yet-on-offer pricing.

It doesn’t matter where it’s from, 50% of an £8 bottle is UK tax, leaving £4 for the retail and wholesale margin, shipping, bottling, packaging, logistics and finally the stuff inside the bottle – plus the farming.

It may be an odd way to think of it but an eight pound bottle of wine in the UK is the same net price as a smallish supermarket chicken, or maybe two chicken breasts or two small packets of fruit on offer (as there’s no tax on these).

Wine in bulk is (mostly) cheap

So how can supermarkets sell so many bottles so cheaply, at prices much lower than £8?

Well, essentially, global wine consumption is lower than production. The Paris-based International Organisation for Vine and Wine (OIV) reckoned last year’s global wine production was down to 237 million hectolitres (mhl) but world wine consumption in 2023 was lower at 221 mhl (down 2.6% from 2022). There’s still plenty of wine trying to find a home.

The UK’s biggest supplier of wine by volume is Australia, with the UK in turn being the biggest market for Australian exports both by volume and by value. Looking at Wine Australia’s most recent export report, ‘according to data from Nielsen IQ for the year ended 3 February 2024, five of the top ten wine brands in the UK off-trade were Australian, and 4 of these experienced growth.’ Australia’s share of the off-trade market is around 24%.

Their report is always refreshingly honest. As much as 91% of Australian exports to the UK went ‘unpackaged’ in huge container bags to be bottled ‘in market’ in the 12 months to 31 March 2024. This makes a lot of sense. Globally, according to Wine Australia, ‘the average value of unpackaged exports declined by 5% to AUS $1.12 per litre’ (FOB or ‘free on board’ export value).

AUS $1.12 per litre is the equivalent of 44p per 75cl bottle. Even though the UK pays a tiny premium ($1.20 a litre), the wine inside the bottle has the same value, on average, as the August 2023 UK duty rise alone, with UK duty at £2.67 now being six times the value of that wine inside the bottle.

The Observer picked up on this last weekend in the article on ‘the cost of doing business, eight years after Brexit.’

‘The vote to leave the EU was sold as a way to cut red tape, but for many it ended up doing the opposite. The Observer asked six businesses about the fallout for them.’ They spoke to Ed Baker, managing director of Kingsland Drinks, Manchester – a large bottling company.

“For an Australian wine you might lose between 7.5p and 9p on the removal of (EU) tariffs but you’ll be paying 44p more on excise duty, and that’s ignoring the extra VAT too,” says Baker.

‘These rules will be altered again from February 2025 when the amount of duty paid on each bottle of wine rises even further, up by 2p for every 0.1% increase in strength. This means that bottles of wine with the highest alcohol by volume could see an extra 43p added next year.’

The UK duty on this Aussie Shiraz at £6.99 went up 44p from £2.23 to £2.67 last August, and at 14% abv will go up again on 1 February by another 32p to £3.

Sunak’s Brexit-inspired policies to change the way that wine is taxed could be felt for years to come: higher prices, poorer quality and value, and a sharp decrease in genuine choice. Let alone the damaging impact of the red tape and increased costs.

Let’s hope a new Government will see sense and make the temporary easement permanent so that wines between 11.5% and 14.5% are taxed at a single level.

Onwards and upwards.