Your guide to UK tax on wine

Posted by Gavin Quinney on 30th Nov 2024

Sandwiched in between the joys of Black Friday and Advent Sunday, we bring you glad tidings with a festive guide to the changes in UK duty which will kick in at the end of Dry January. You may want to adjust your wine purchases accordingly in the run up to Christmas to avoid a bleak mid winter soon after, and beyond.

There has been some confusion about how wine is going to be taxed and by how much, so here is a handy portfolio of tables, graphics and photos.

If you have any questions, suggestions or would like to get in touch, please email us both by clicking this link.

All the best

Gavin & Angela Quinney

PS Sorry to bang on about it but how has the UK ended up with 66 bands of duty on wine to replace just 2 and, worse still, the highest rates of duty on wine in Europe from February?

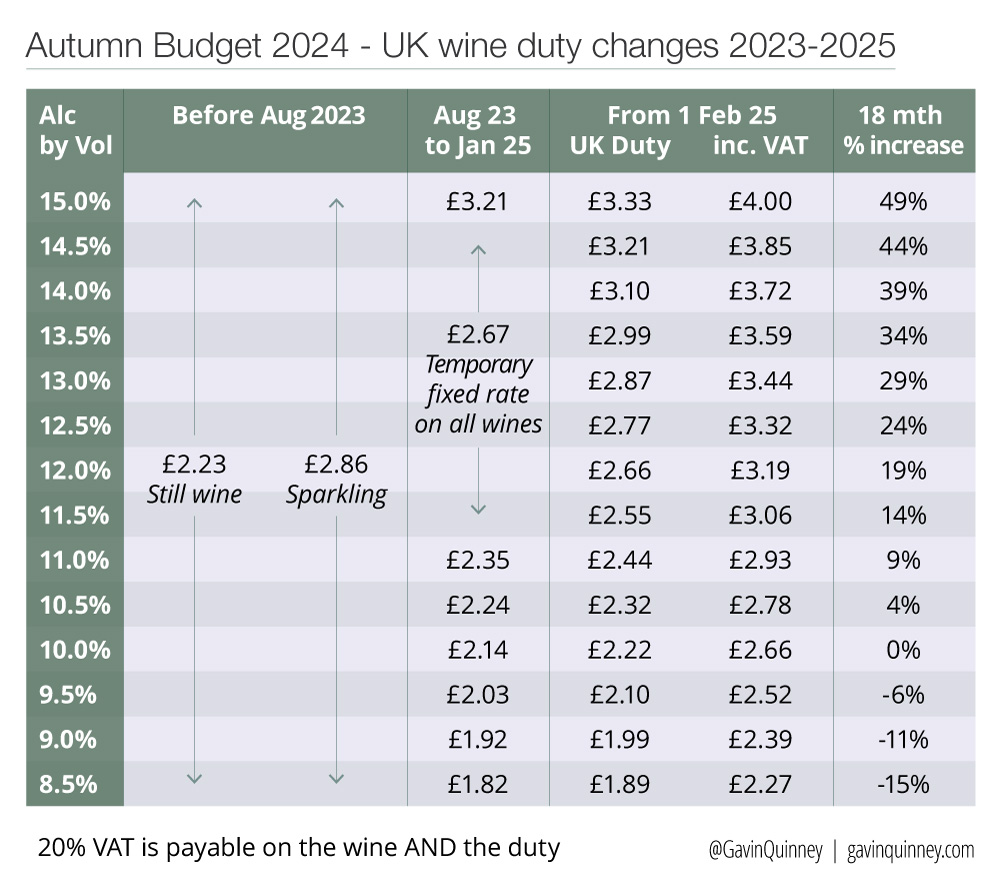

The table above shows where we were in 2023, where we are in 2024 and where we’re heading in two months’ time.

In last month’s newsletter, I mentioned how the UK trade had tried to warn the new Labour Government that endorsing Rishi Sunak’s unwieldy and costly system would be bad news for consumers, the hospitality sector, for wine merchants and, indeed, for the Treasury. Sadly it was all to no avail, and if you’d like to write to your MP about any of this, it should be easy to find your MP listed here. (If such a thing were to happen in France, you wouldn’t be able to move for tractors in Paris, and not just for a day.)

Wine is now taxed in the UK on the level of alcohol as shown on the label. The system was brought in on 1 August 2023 and, to help the wine trade, a temporary fixed rate for the majority of wines was introduced for those from 11.5% to 14.5% ‘alcohol by volume’ or ‘abv’. Mind you, UK excise duty on still wine at that level went up from £2.23 to £2.67 a bottle plus VAT (53p inc VAT). That 20% increase alone was the biggest in over 50 years.

From 1 February 2025 the temporary rate of £2.67 plus VAT – or ‘easement’ as the Government called it – will now end as planned, as confirmed in the Budget smallprint.

‘£29.54 per litre of alcohol in the product for duty on all alcoholic products at least 8.5% but not exceeding 22% alcohol by volume‘ (from 1/2/25) might sound simple enough.

The formula, by the way, is to multiply the litres by the abv strength and then multiply this figure by the duty rate. Eg 0.75 (cl) x 0.125 (abv) x £29.54 = £2.77.

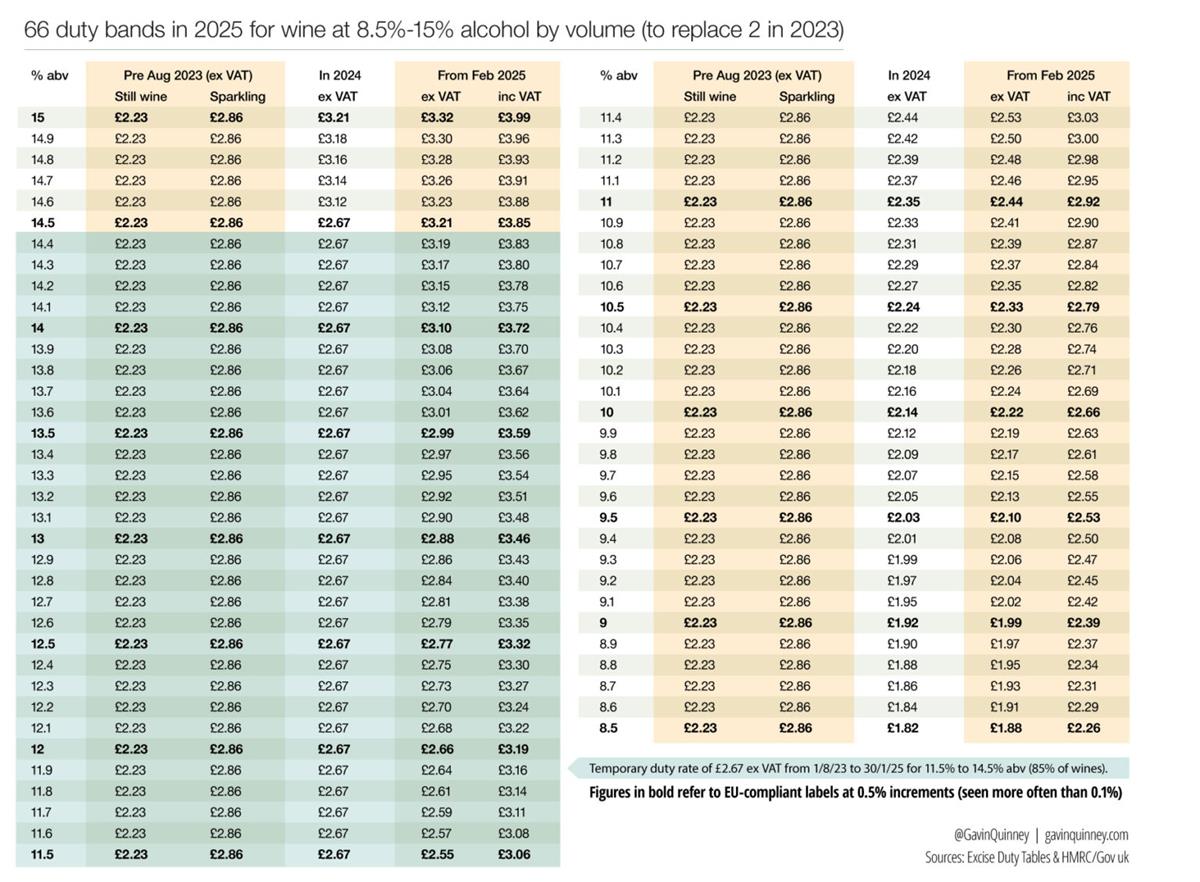

However, while the Treasury was using one ‘Brexit freedom’ to tax wine on the level of alcohol from last summer, Defra made up one of their own by allowing producers to include a decimal place on a label, instead of the EU increments of 0.5% abv.

So from February 2025 there will be 135 bands of duty for 8.5% – 22% abv, one for every decimal point, to replace the THREE that were used pre-Brexit for still, sparkling and fortified wines. Can anyone have thought back in June 2016 that… oh, never mind, though let’s just remind ourselves of Sunak’s Budget speech as Chancellor in October 2021:

‘We are taking advantage of leaving the EU to announce the most radical simplification of alcohol duties for over 140 years.’

Above is the duty chart for 8.5% to 15% abv, which excludes the fortified stuff up to 22% abv like port and sherry. The block in green shows the ‘easement’ category which ends on 1/2/25. The total number of bands of duty for 8.5%-15% wine will be 66, replacing just two.

From the two tables above it’s clear that wines with higher alcohol will go up quite a lot from 1 February, on top of the increase last August. And don’t forget that the level of alcohol for any wine can change with every vintage.

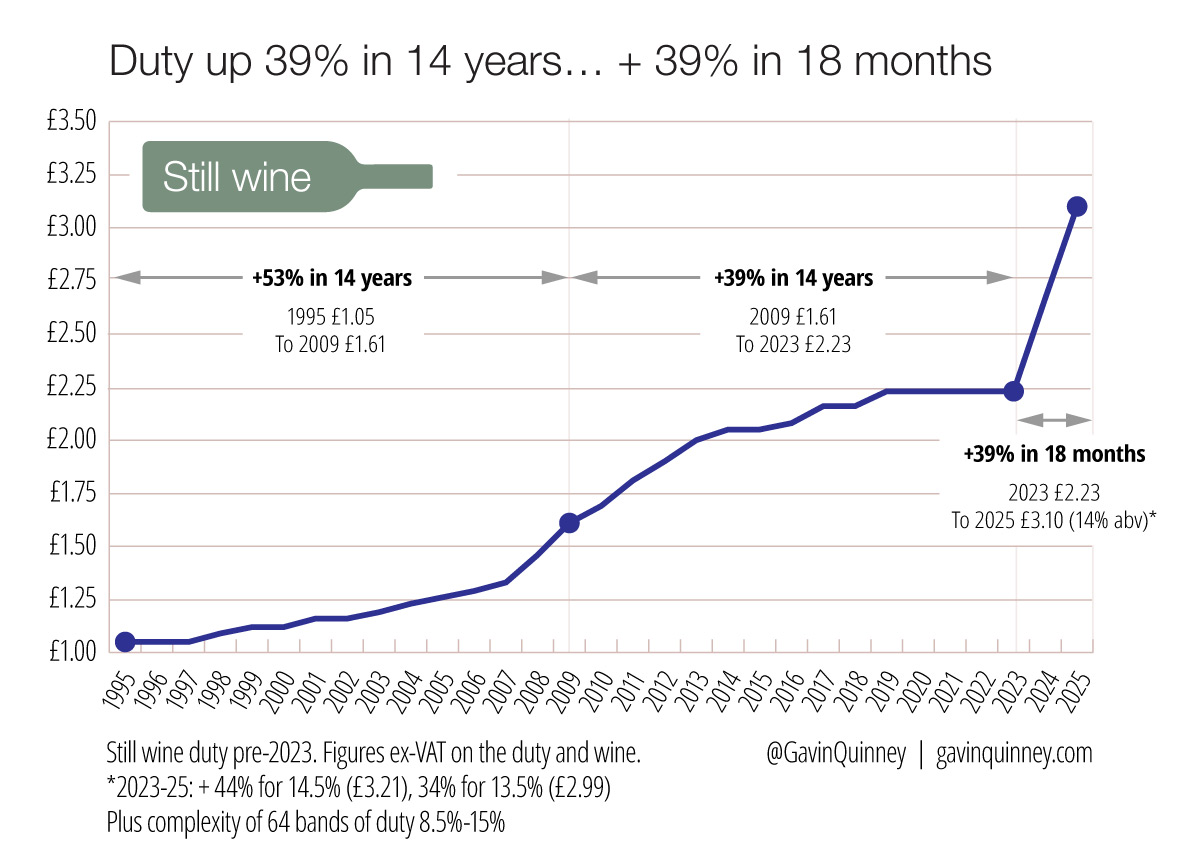

The duty on wine increased by 39% over 14 years from 2009 to 2023 and a wine at 14% abv UK duty is up another 39% in just 18 months (1/8/23 to 1/2/25). That 39% figure goes up to 44% for wine at 14.5% abv or drops to 34% for 13.5% abv.

This month, the wine writers Tim Atkin and Jancis Robinson – both highly respected Masters of Wine – urged their (British) subscribers respectively to write to their MPs in support of #CapTheWineTax in their weekly newsletters. Tim’s letter can be seen here and the letter from Jancis here.

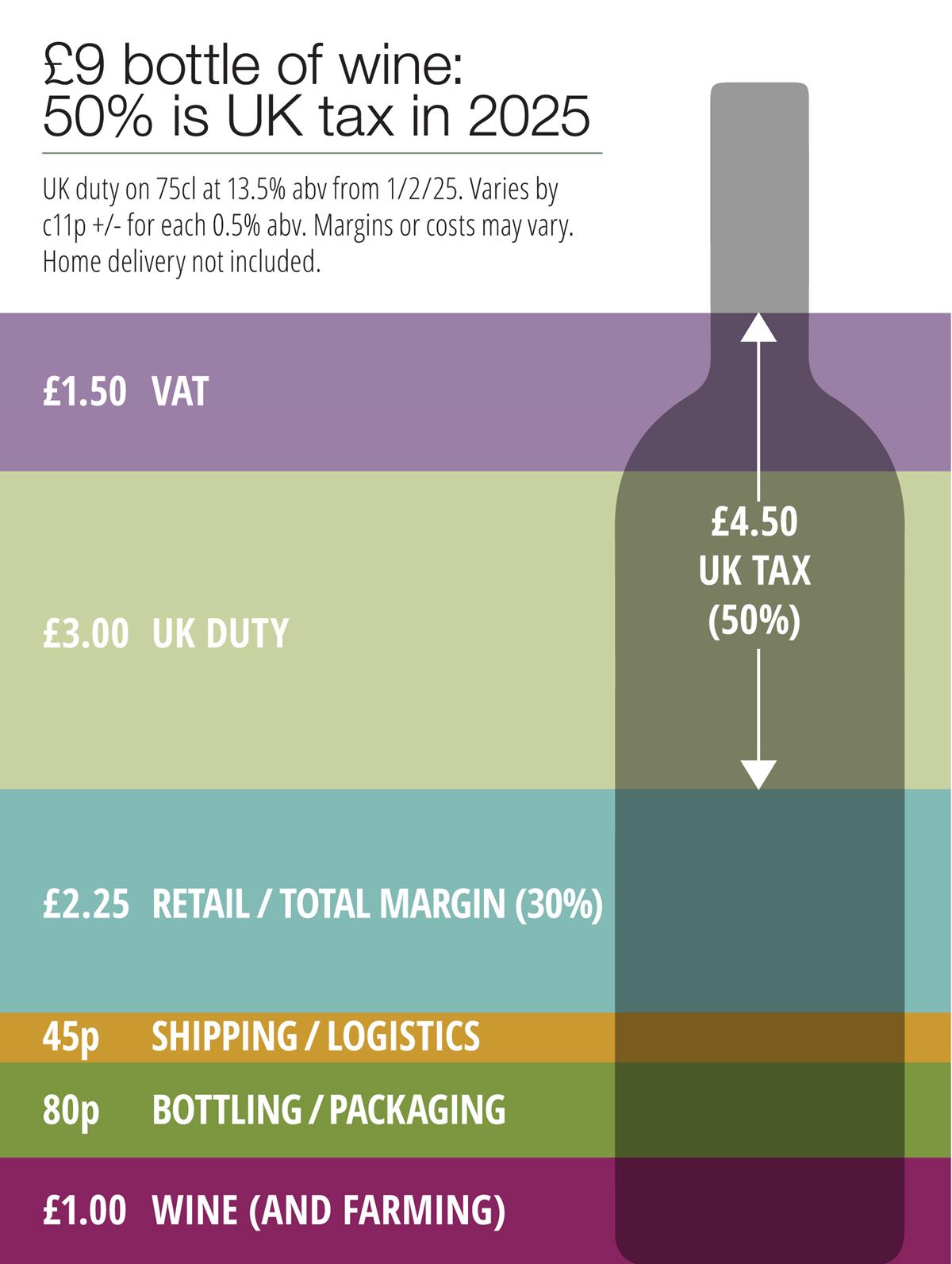

They both picked up on a stat that I’d mentioned to Tim about the duty from February. ‘When you buy a £9 bottle of wine at a pretty normal 13.5% alcohol, half of that will be UK tax. Not much left for the liquid itself…’ he wrote in his weekly email on 15/11/24.

‘Half of the purchase price of a £9 bottle of wine at 13.5% alcohol, for instance, will go straight to the UK government, leaving little for the wine itself once everything else has been paid for.’ Jancis Robinson MW’s weekly newsletter, 15/11/24.

Here’s a simple graphic:

Most people would think that £9 for a bottle in a supermarket is a premium wine – especially if it’s 25% off a ‘normal’ price of £12. (‘25% off for 6’ being a regular offer across multiple supermarkets.)

And you’d be right to think that, statistically. Almost 90% of wines sold in the off-trade (mostly in supermarkets) went for less than £9 a bottle earlier this year. The 2024 UK market for bottles that sell for £9 or more in stores is only a little over 10%.

An unstoppable force meets an immovable object come 2025?

Let’s just see how alcohol varies between red and white wines, and therefore how the different styles might be impacted. For this, I’ve taken Jane MacQuitty’s recommended wines for winter in The Times that were published over two weekends in November, shown above and below.

Remember that for 2024, the temporary fixed rate is based on wines at 12.5% abv.

With Jane MacQuitty’s 50 red wines, 3 of these are fortified so they’re obviously higher than 12.5% abv. For the other 47 wines that she recommends, 40 are higher than 12.5% abv so all those will see higher duty come 1 February. 5 are at 12.5% (so they’ll go up too but only by Labour’s 3.65% RPI increase on today’s rate). Only 2 were lower than 12.5%. Wine critics – and their readers – prefer ripe, juicy and flavoursome reds. Some lighter reds in summer maybe, but still.

With Jane’s 50 white wines it’s a different picture. 7 were sparking wines and they’re all slightly lower than 12.5% abv. Note from the tables above that duty on sparkling wine at 12% abv hardly moves on 1 Feb, from £2.67 to £2.66 plus VAT, but at least that’s better than the £2.86 before August 2023. (Our Crémant is a lowly 11% abv at £2.44 duty so at least that’s one small crumb of comfort.)

Of the 43 still whites, 15 are above 12.5% abv, 15 are 12.5% and 13 are below 12.5%. So it’s much more of a spread. This comes as little surprise because good whites can come in all shapes and (alcohol) sizes.

Given that the selected wines are as low as 8% abv (technically not wine, below 8.5%?) and as high as 14.5% abv, with lots in between, two things spring to mind.

First, it’s easier to find decent whites with lower alcohol than it is for their red counterparts. (Though it’s not plain sailing with reduced alcohol and the old ‘early harvesting’ PR guff.)

Second, wine merchants and the trade are really going to have their work cut out administering such a broad range of alcohol levels with different whites and applicable duty rates.

Going back to the bottle of wine with 13.5% alcohol. That might be a typical red in a reasonable vintage from Bordeaux or the Rhone valley, or from Italy, Spain, Portugal, Austria and elsewhere in Europe, or anywhere across the Southern hemisphere – Argentina, Chile, South Africa, Australia or NZ. Or indeed a good Chardonnay or whatever.

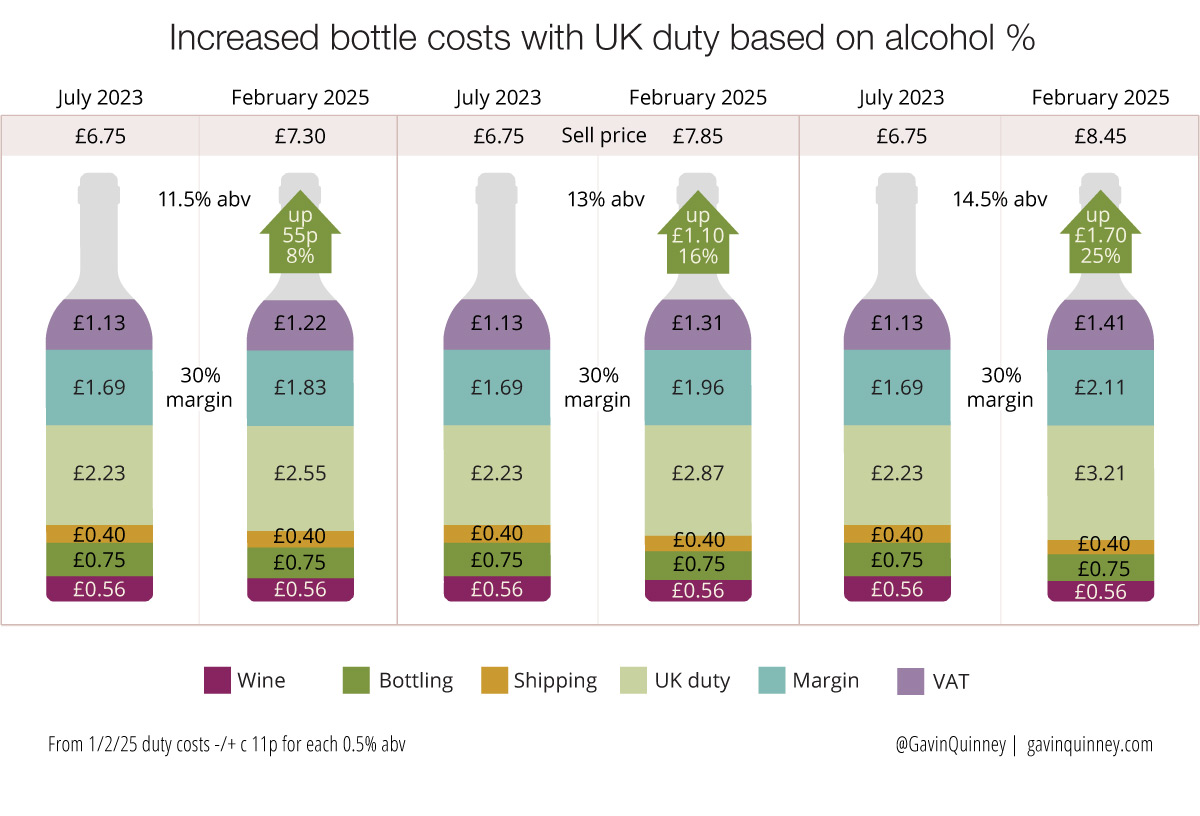

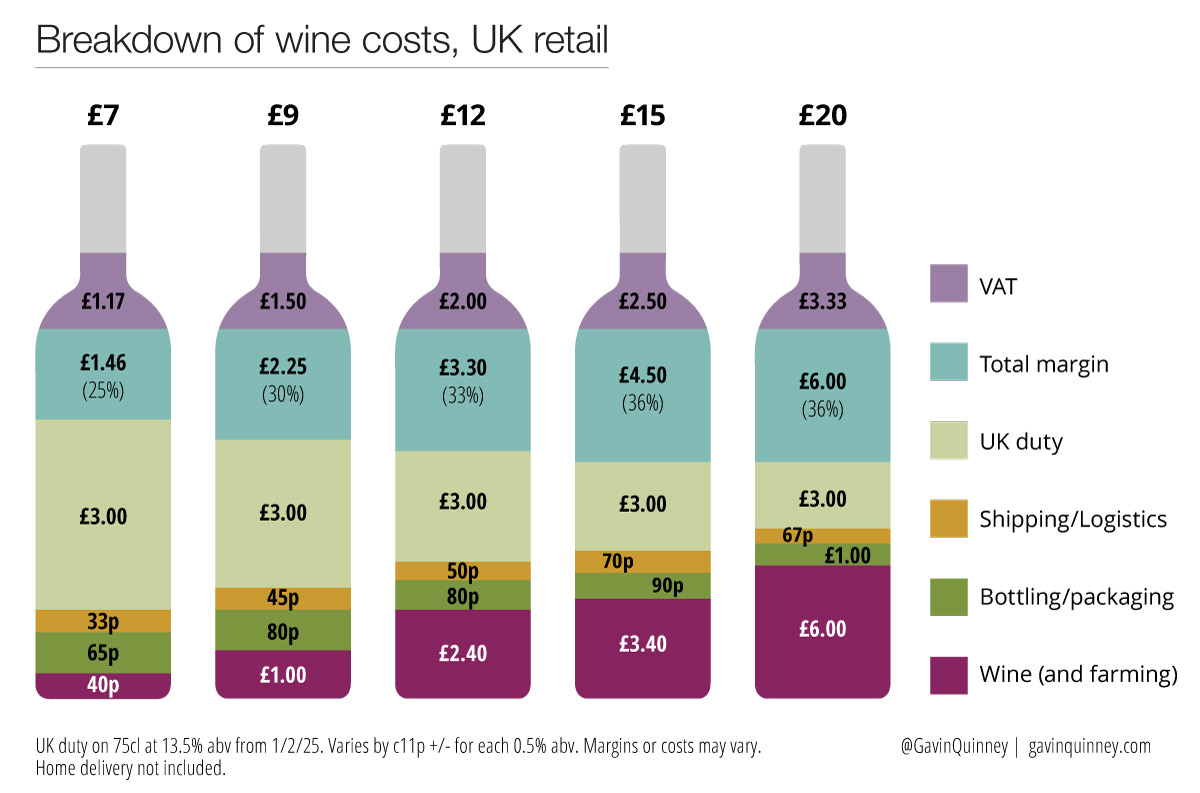

Here’s how you’d get more bang for your buck by trading upwards – assuming prices are correct and fair. (When it comes to supermarkets, the offer price is often the price.) The costs at the foot of the bottles reflect the type of wine – on the left, an inexpensive wine shipped in bulk and bottled in the UK. On the right, more premium wines (£15 to £20+) that are transported in decent but more modest volumes. Granted, a bottle costing just over £4 at source might not be a premium wine (retail £15) but you see my point. It’s a small, fairly exclusive market at £15 plus.

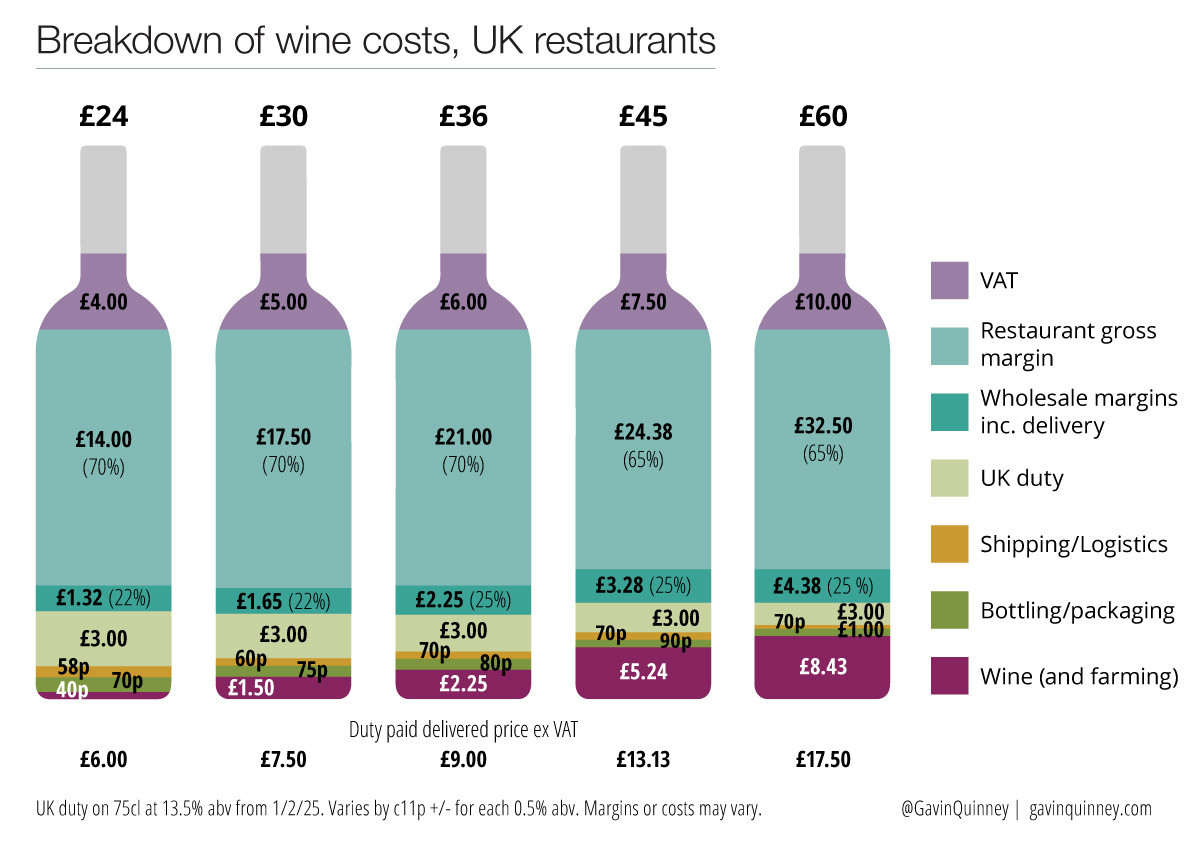

Now for restaurants and pubs. Most restaurants need to make 70% gross margin on wine, and sometimes more – especially at the cheaper end of the list.

The reality though will be quite tough. For a wine listed at £24, I would expect the cost price of the wine, delivered to the restaurant, to be £6 excluding VAT. (As a consumer, divide the list price by 4 for the ex-VAT cost price for a 70% GM wine.) This allows for £24 to have £4 VAT and £14 gross margin, leaving £6. For a wine at 13.5%, UK duty would be £3, as in half the cost price. The liquid inside really can’t cost much at all at source.

UK duty is a killer at this end of the list.

How can it be possible to supply wine at such a low cost for both the on and off-trade? One solution comes from blending bulk wines – for own label and low cost brands – and prices are weak given that global production still outstrips worldwide consumption.

‘World trade of bulk wine represents roughly one-third of total wine trade by volume but only 6.6% by value, given its low average price of €0.73/l at the end of 2023.’ (About 46p for 75cl.)

Source Meininger’s International, Oct 2024.

Meanwhile, I’ve updated a number of other important tables.

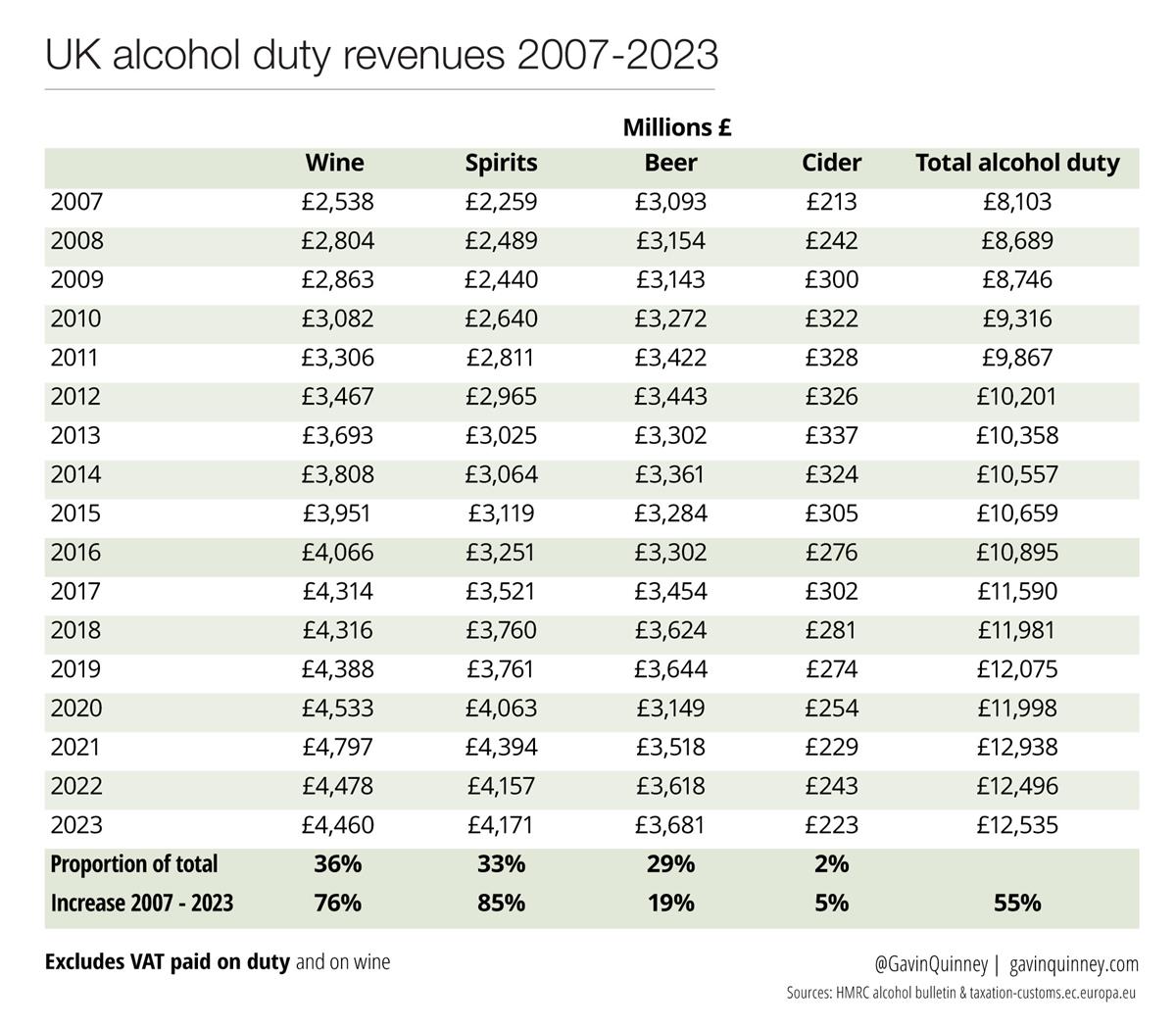

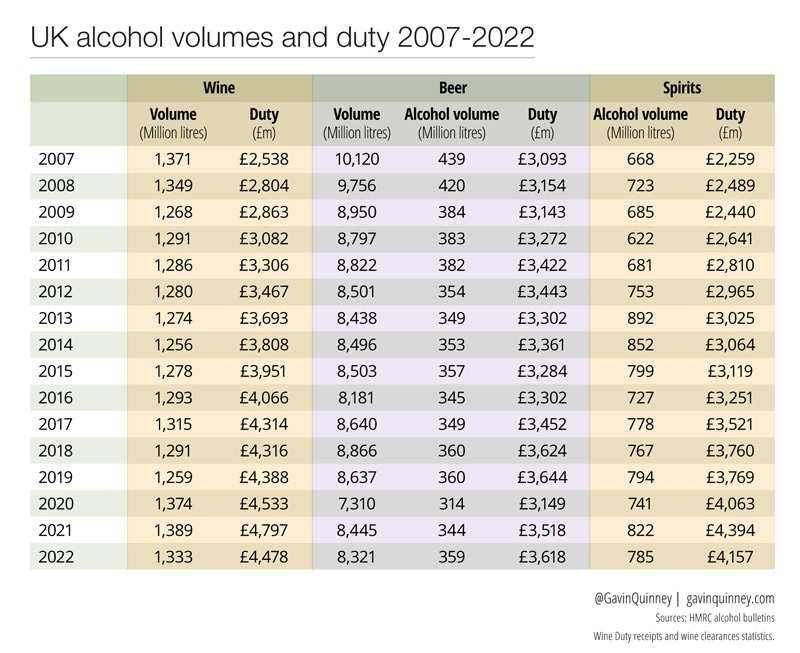

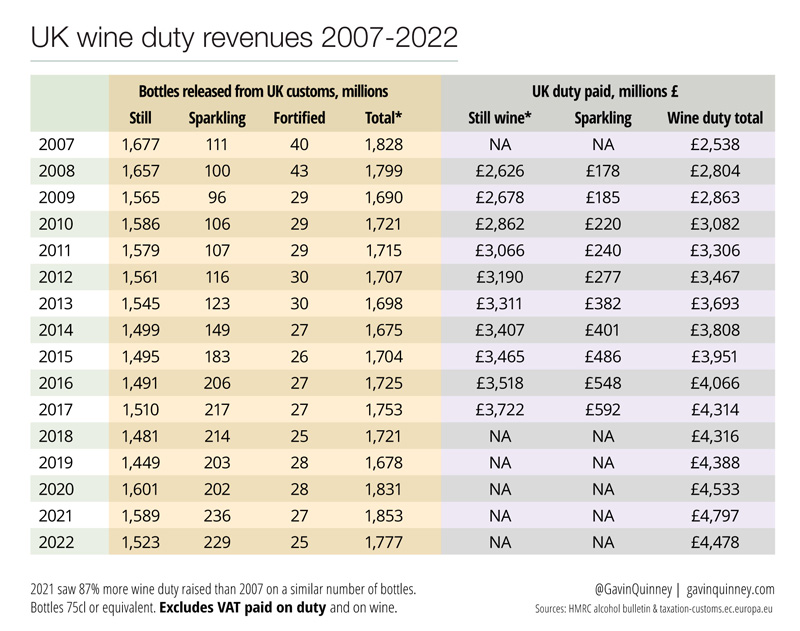

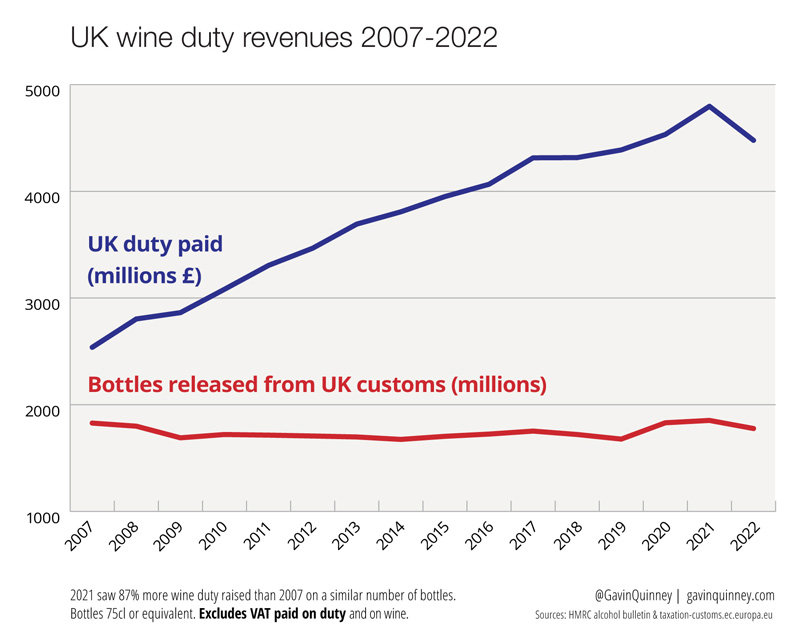

Wine has a fantastic record of contributing hugely to HM Treasury. It provides the most duty of all alcohol categories to the Exchequer, above, with almost £4.5 billion collected out of £12.5 billion in total alcohol duty in 2023, ahead of spirits (£4.2 bn) and beer (£3.7 bn) – plus VAT.

Bizarrely, the volume figures for wine for 2023 are missing from HMRC’s alcohol bulletin (!). I’ve asked the Wine and Spirit Trade Association, of which we’re members, to enquire further.

87% more wine duty was paid in 2021 (£4.8bn) than in 2007 (£2.5bn) on a similar number of bottles. If just inflation had been applied to the £2.5bn, the 2021 receipts would have been £4bn.

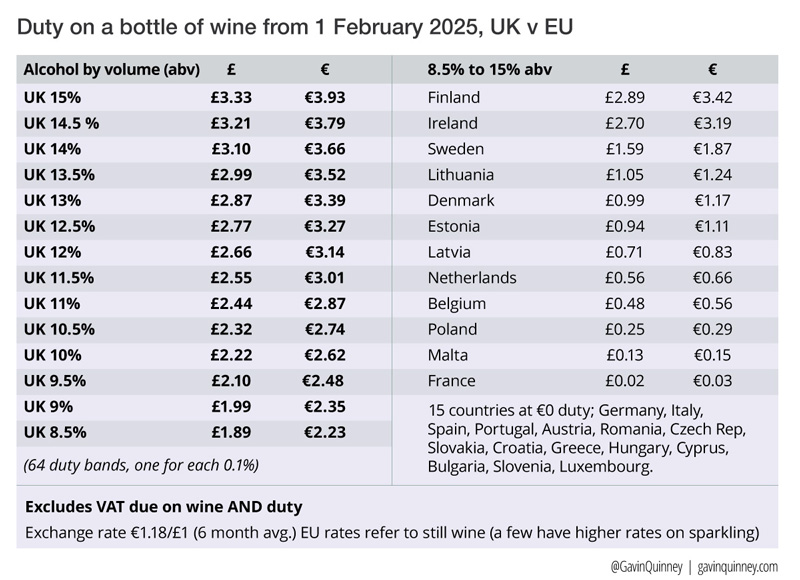

How do UK duty rates on wine compare with the EU?

Here is the picture for 2024. Given that over 99% of wine consumed in the UK is imported, these really could be considered as tariffs.

Most people in the wine business on the continent think the UK has lost plot when you explain what’s coming in February.

‘We are taking advantage of leaving the EU to announce the most radical simplification of alcohol duties for over 140 years.’

Sorry to repeat Rishi Sunak’s words from his Budget speech of October 2021. But seriously – multiple bands of duty on wine at higher rates than the rest of Europe for any wine over 13% abv – to replace just two?

From 1 February 2025, in fact, a wine in the UK with 13% abv will have twice the level of duty (£2.87) per bottle than the total duty per bottle in 20 EU states if added together (€1.69 combined), including the Netherlands, Belgium and Poland:

Now all endorsed by Labour, absurdly.

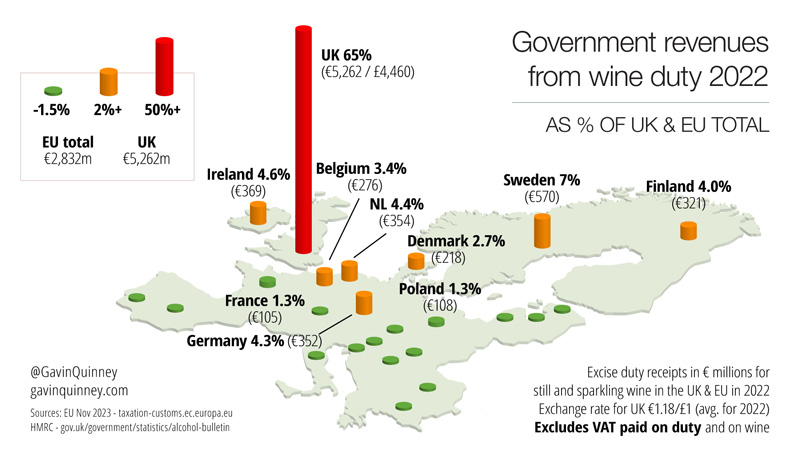

It’s not as if wine drinkers in the UK weren’t being soaked before. Here’s an update of my map showing the amount of duty on wine paid across Europe.

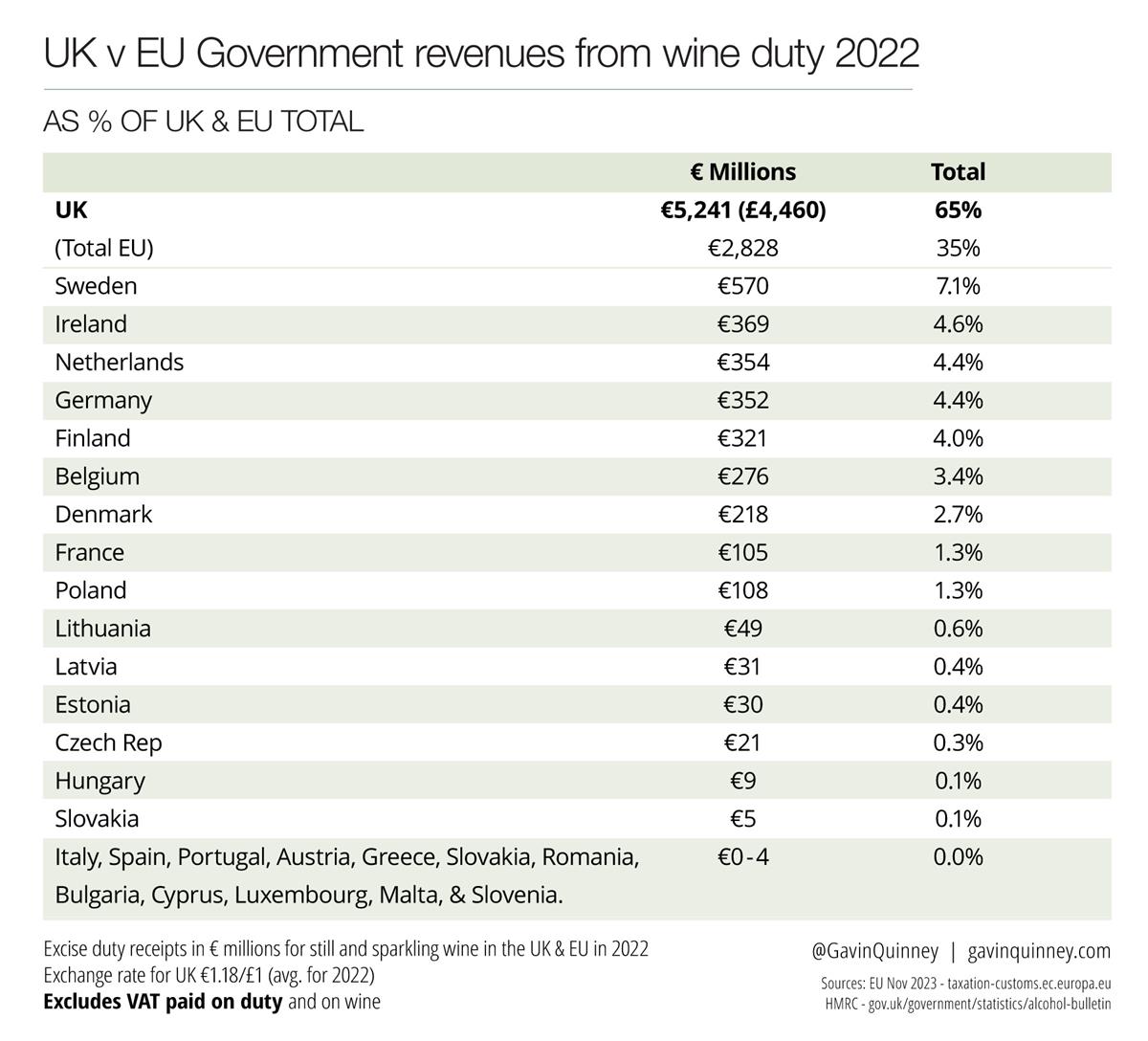

65% of all wine duty across the EU and UK combined was levied by the UK.

Here is the list of duty revenues by country.

If you’ve made it this far, well done and many thanks. We probably all need to go and have a lie down, before the Christmas rush.

Onwards and upwards.